The Employment Allowance and Employer’s National Insurance Contributions

The Employment Allowance is a type of relief available to some employers to help reduce the cost of their National Insurance contributions by up to £5,000 each year. We’ve prepared this guide to explain which employers can use the Employment Allowance, and how the process works. If you’re brand new to being an employer, we also have a guide to help first time employers get started.

What is employer’s National Insurance?

An employee’s National Insurance is actually made up of two parts; the employee’s own contribution which is deducted from their wages before they get paid, and then a separate contribution which the employer makes in addition to the wages they pay.

- Employees pay Class 1 (Primary) National Insurance if they are younger than State Pension age and earn more than the Primary Threshold. In 2024/25 the Primary Threshold is £12,570. The NI they owe is deducted from their wages.

- Employers pay Class 1 (Secondary) National Insurance on an employee’s earnings above the Secondary Threshold, which in 2024/25 is £9,100, but this reduces to £5,000 from April 2025. Employer’s NI is paid in addition to the wages they pay.

As the employer, it’s you who manages Class 1 National Insurance. You’ll deduct the employee’s contribution from their wages before it lands in their bank account. This deduction, along with your contribution for employer’s NI, is paid on to HMRC.

If this is all brand new, take a look at our PAYE guide to learn more about reporting your employees’ tax and NI to HMRC.

What is the Employment Allowance?

This is where it gets really interesting as the Employment Allowance could shave a significant amount off your outgoings. The Employment Allowance only applies to the employer’s contribution towards National Insurance. The amount that your employee contributes doesn’t change and isn’t impacted.

Providing you are eligible (more on that below), you could save up to £5,000 per tax year in relief. It means that each time you run payroll you’ll pay less employer’s NI, until you use up the allowance, or start again in a new tax year.

Once you’ve used up your full £5,000 allowance in a tax year, you’ll need to start paying any remaining employer contributions towards National Insurance.

You don’t need to be paying more than £5,000 to qualify, either. Even if your bill for employer’s NI is less than £5,000 in a year, you can still benefit from the Employment Allowance.

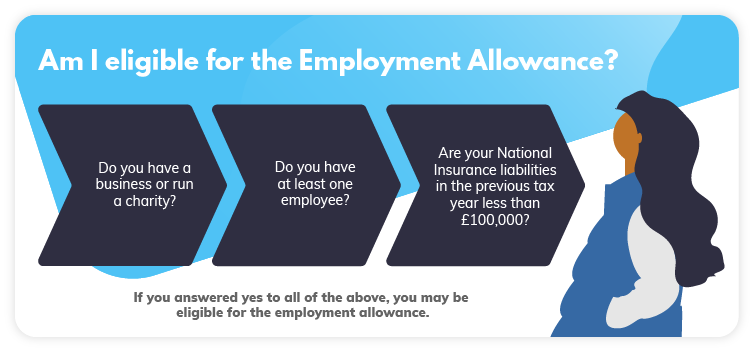

Am I eligible for the Employment Allowance?

There are three basic criteria to qualify for claiming the Employment Allowance.

- Do you run a business or a charity?

- Do you have at least one employee (or at least 2 directors if you don’t have any employees) earning more than the Class 1 NI Secondary Threshold?

- Is your bill for employer’s NI from the previous tax year less than £100,000?

Check, check, check? If you’ve met all three criteria, there’s more to learn and you’re in the right place. Read on!

Are there any exceptions?

You can probably guess that qualifying for the Employment Allowance isn’t quite as straightforward as that. Remember that one employee you must have in order to be eligible?

That employee can’t be both a director of the business and the only employee who’s paid more than the Secondary Threshold for National Insurance. This is the amount that employees can earn before their employers must start contributing towards their National Insurance. In 2024/25 the Secondary Threshold amount is £9,100 per year, but this threshold reduces to £5,000 from April 2025.

It also means you’re unable to claim the Employment Allowance if you employ several people, but the director is the only one paid above the National Insurance Secondary Threshold.

If you’re the sole director and employee of your business, you might also find it useful to read our article about the most tax efficient salary to pay yourself.

I make or sell goods or services, are the rules different?

Yes! This is where state aid rules come into play. The Employment Allowance is counted as part of the ‘de minimis state aid’ for those that make or sell goods or services. Depending on your sector, there is a limit to the amount of state aid you can receive over a three-year period.

To understand if you’re eligible to claim Employment Allowance you will need to:

- Check whether you’re within the de minimis state threshold

- And also calculate how much state aid you’ve received

As state aid is part of an EU initiative to ensure fair competition, the threshold is calculated in Euros. Sectors are split into four key areas:

| Sector | De minimis state aid threshold over 3 years |

| Agriculture products | €20,000 |

| Fisheries and aquaculture | €30,000 |

| Road freight transport | €100,000 |

| Industrial / other | €200,000 |

How do I claim the Employment Allowance?

You can make a claim for the Employment Allowance as part of your PAYE reporting process. Either:

- Using HMRC’s Basic PAYE tool, or;

- With your payroll software.

Simply tick the box that indicates you will be claiming the Employment Allowance. If you make or sell goods or services, you’ll also need to indicate that state aid rules apply. Select the relevant business sector, even if you don’t make a profit.

When can I make a claim?

The Employment Allowance is allocated each tax year, so you’ll need to claim for every tax year that you’re eligible for the relief. You can apply at any time during the tax year but the sooner you get your application in, the sooner you’ll get the allowance.

Help! I’m late making a claim

Don’t panic. You haven’t missed out. It just means that the process for claiming your Employment Allowance is slightly different. You can ask HMRC to either:

- Use your unclaimed allowance to pay any outstanding tax bills or National Insurance, or;

- Refund you after the end of the tax year, if you don’t owe anything.

I’ve submitted my claim for the Employment Allowance – what next?

You can start using your Employment Allowance as soon as you submit your claim. There’s no need to wait for confirmation from HMRC, and there is no formal letter to give you the green light.

The only time HMRC will contact you regarding your application is if they reject your claim. In that instance, you’ll receive a message from HMRC within 5 working days of making a submission.

Is there a deadline to claiming the Employment Allowance?

There is currently a 4-year limit in place, so if you didn’t know about the Employment Allowance, or just didn’t find the time, you can still claim for the previous 4 tax years.

Be aware though, that there are different rules for historical claims! We advise consulting with an accountant on this one.

Stay up to date

Spend time familiarising yourself with the eligibility criteria. If your circumstances change, for example you change the nature of your business or you reduce the number of employees, make sure you’re still eligible to claim the Employment Allowance.

The Employment Allowance is just one of the relief schemes available to help UK businesses with National Insurance. Read our article about NI Relief to learn more.

Learn more about our online accounting services. Call 020 3355 4047 to talk to one of the team, or get an instant online quote.

Want to learn more?

Subscribe to our newsletter to get accounting tips like this right to your inbox

Read more posts...

Your Guide to Capital Allowances for Cars

21st February 2025Capital allowances can be confusing to get your head around, but well worth getting to grips with – especially if you can…

Read More

Paying Tax on Lottery Winnings

18th February 2025The chance of winning the jackpot lottery in the UK is around 1 in 14 million. The odds aren’t high, but you’ve…

Read More

The Accountancy Partnership – Our Positive Reviews

17th February 2025We’re proud of our customer reviews here at The Accountancy Partnership The reviews we receive from our customers show how hard we…

Read MoreConfirm Transactions

The number of monthly transactions you have entered based on your turnover seem high. A transaction is one bookkeeping entry such as a sale, purchase, payment or receipt. Are you sure this is correct?

Please contact our sales team if you’re unsure

VAT Returns

It is unlikely you will need this service, unless you are voluntarily registered for VAT.

Are you sure this is correct?

Call us on 020 3355 4047 if you’re not sure.

Bookkeeping

You will receive our bookkeeping software Pandle for free, as part of your package.

You can use this to complete your own bookkeeping, or we can provide a quote to complete your bookkeeping for you.

Please select and option below:

Call us on 020 3355 4047 if you’re not sure.

Hi, thank you for this post. Makes it easy to understand for people (including myself) who are not numbers people! Have one question I hope you can help with. My husband has his own Ltd company which I am a director of too but he is 100% shareholder. My husband pays himself £12,570 and I get £9,100 salary per year. There are no other employees. The employment allowance is claimed for this company. I also have an unconnected Ltd company in a different industry where I am the sole director, employee and 100% shareholder paying myself £12,570 per year. Now… Read more »

Hi Jane

You’re very welcome, thanks for your kind words!

OK, so based on the information provided this should be fine – although taking two salaries might affect tax efficiency, so this might be something to think about. Our article about director’s salaries explains this a bit more, but please do let us know if you need any help!

Best wishes

Elizabeth